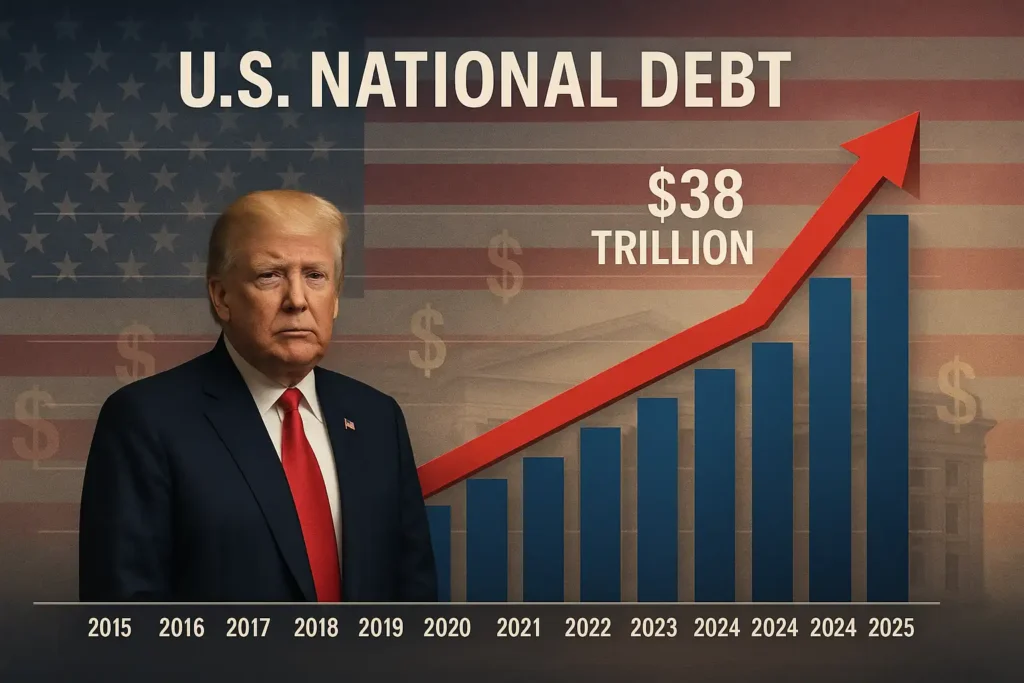

How the Debt Ballooned to $38 Trillion

As of late 2025, America’s National Debt 2025 stands at a staggering $38 trillion — the highest in the nation’s history.

This explosion stems from a mix of fiscal stimulus packages, rising interest rates, and structural deficits.

Post-pandemic economic support and investments in AI-driven infrastructure have added trillions more to the already swollen debt.

In addition, interest payments alone have reached over $1 trillion annually, meaning that servicing debt now costs more than national defense or healthcare spending.

The Trump Factor and Fiscal Policy Legacy

While the debt trajectory accelerated during the pandemic, much of the debate still circles around the Trump-era fiscal reforms.

Tax cuts introduced between 2017–2019 significantly reduced federal revenues, and increased corporate spending created a temporary growth surge — but also deepened fiscal imbalances.

By 2025, both Democrats and Republicans continue to clash over whether these policies ignited a long-term structural debt crisis.

In political and media circles, Donald Trump’s policies remain a symbolic pivot point for discussing the roots of the modern debt surge.

Global Repercussions of America’s National Debt 2025

America’s debt doesn’t just affect Washington — it reshapes the global economic order.

The U.S. dollar serves as the world’s reserve currency, meaning any instability in U.S. fiscal health reverberates across global markets.

Here’s how it affects the world economy:

| Impact Zone | Global Consequence |

|---|---|

| Emerging Markets | Fluctuations in dollar strength affect import/export balances, leading to inflationary pressures in developing nations. |

| Europe | ECB faces challenges stabilizing Euro amid rising U.S. Treasury yields. |

| Asia | China and Japan — the top two holders of U.S. debt — face valuation losses on U.S. bonds. |

| Global Trade | Volatile dollar and debt-driven uncertainty dampen long-term investment decisions. |

AI, Energy, and Debt — A New Economic Triangle

The AI revolution in 2025 has boosted innovation but also created immense financial strain.

Big Tech giants — Microsoft, Alphabet, Meta, and Amazon — collectively invested $370 billion in AI infrastructure.

This corporate spending lifted market optimism but increased national energy consumption and widened fiscal deficits due to new subsidies and tax incentives.

Essentially, America’s National Debt 2025 represents both economic ambition and financial overreach.

Is the U.S. Headed Toward a Fiscal Cliff?

Economists remain divided. Some argue that as long as the U.S. maintains global confidence in the dollar, it can sustain high debt levels.

Others warn of a “slow-motion crisis,” where mounting interest payments and reduced policy flexibility will eventually trigger stagflation or even a bond-market correction.

The Federal Reserve continues its balancing act — raising rates to curb inflation while trying not to stifle growth.

But the margin for error is shrinking fast.

Conclusion

In 2025, America’s National Debt has become a defining issue not just for U.S. policymakers, but for the global economy.

It reflects a complex intersection of policy choices, technological transitions, and global dependencies.

The real challenge lies in striking a balance between innovation and responsibility — ensuring that progress doesn’t come at the cost of long-term fiscal sustainability.

The world is watching closely as the United States stands at a pivotal crossroads between economic growth and debt-driven vulnerability.

FAQs

1. What is America’s National Debt in 2025?

The U.S. national debt crossed $38 trillion in October 2025 — the highest level in history.

2. Who holds the largest share of U.S. debt?

China and Japan remain the largest foreign holders, with domestic investors and pension funds holding a majority share.

3. How does America’s debt affect global markets?

Rising debt leads to higher Treasury yields, stronger dollar fluctuations, and potential instability in emerging markets.

4. Did Donald Trump’s policies contribute to this debt rise?

Yes, his 2017–2019 tax reforms reduced government revenues and contributed to long-term fiscal deficits.

5. Can the U.S. government default on its debt?

A technical default is unlikely due to the dollar’s global reserve status, but political standoffs (like the debt ceiling debates) pose short-term risks.

6. How does AI investment tie into the national debt?

AI infrastructure spending has added hundreds of billions in subsidies and tax credits, increasing government expenditure.

7. What happens if the U.S. continues borrowing at this rate?

It risks higher interest costs, reduced credit ratings, and global investor caution toward Treasury bonds.

8. What is the difference between deficit and debt?

The deficit refers to yearly government overspending, while debt is the accumulation of all past deficits.

9. How is this debt impacting average Americans?

It indirectly raises inflation, affects mortgage rates, and could slow future government programs.

10. What steps can reduce the national debt?

Fiscal discipline, reduced military spending, higher tax compliance, and targeted reforms in healthcare and social security.

Author Note

Written by Abhishek Chouhan, an experienced finance and economics blogger with over 10 years in financial markets and global macro analysis. He regularly writes on global investment, economic trends, and policy impacts.

Disclaimer

This article is for educational purposes only. It does not constitute financial or investment advice. Readers should consult a licensed financial advisor before making any investment or policy-related decisions.

1. Reuters – U.S. National Debt Surpasses $38 Trillion

URL: https://www.reuters.com/world/us/trump-tax-bill-averts-one-debt-crisis-makes-future-financial-woes-worse-2025-07-03/

Suggested Anchor Text:

According to a recent Reuters report, America’s national debt crossed $38 trillion in October 2025.

2. IMF – Global Fiscal Monitor 2025

URL: https://www.imf.org/en/Publications/fm

Suggested Anchor Text:

The International Monetary Fund’s Fiscal Monitor highlights how rising debt levels across developed economies are reshaping fiscal policy globally.

3. The World Bank – Global Economic Prospects Report 2025

URL: https://www.worldbank.org/en/publication/global-economic-prospects

Suggested Anchor Text:

The World Bank’s 2025 Global Economic Prospects report warns that excessive debt accumulation could limit fiscal flexibility worldwide.

How AI is Revolutionizing Financial Services: The Global Economic Impact in 2025

One comment