n 2022, Jerome Powell raised interest rates by 4.5% and erased $12 trillion from global markets. One man. One decision. Trillions gone. This isn’t conspiracy theory—it’s the brutal reality of how interest rates control global markets. The Federal Reserve doesn’t just influence your mortgage or credit card; it weaponizes interest rates to manipulate stock prices, crash currencies, and decide which countries thrive or collapse.

You’re about to discover the hidden mechanism that moves more money than all the world’s stock exchanges combined.

The Interest Rate Weapon: What They Don’t Teach You

Interest rates are the cost of borrowing money. Simple enough. But here’s what Wall Street won’t tell you: how interest rates control global markets isn’t about economics textbooks—it’s about power.

When the Federal Reserve changes its target rate, it sends shockwaves through every asset class on Earth. Your retirement account. Real estate prices. The dollar in your pocket. Gold. Bitcoin. Oil. Everything moves.

The Federal Reserve controls the federal funds rate—the rate banks charge each other for overnight loans. This single number cascades through the entire financial system. Mortgage rates follow. Corporate borrowing costs adjust. Stock valuations recalculate. Currency traders scramble.

This is the throttle of the global economy. And the Fed’s hand is always on it.

Why Central Banks Use Rates as Their Primary Weapon

Central banks have three tools: interest rates, money printing, and regulatory changes. But rates are the nuclear option.

Raising rates = Economic destruction. Higher borrowing costs strangle businesses. Credit card debt becomes unbearable. Mortgages dry up. Stock valuations collapse because future earnings are worth less when discounted at higher rates. The math is brutal.

Cutting rates = Market euphoria. Cheap money floods the system. Companies borrow billions to buy back stock. Real estate booms. Investors chase yield in riskier assets. The party begins.

The Fed uses this weapon with one stated goal: controlling inflation while maintaining employment. But the real effect? They decide who wins and who loses.

In 2008, they cut rates to zero and saved the banking system. In 2020, they did it again during COVID. Both times, the wealthy got wealthier while regular people watched assets they couldn’t afford skyrocket in price.

The Domino Effect: How One Rate Change Destroys Markets

Here’s the brutal truth about how interest rates control global markets: nothing escapes.

Stock markets react first. Higher rates mean two things: companies with debt face higher interest payments, and future earnings are worth less today. Tech stocks? Obliterated. Growth companies trading at 50x revenue? Cut in half. The 2022 massacre proved this when the Nasdaq dropped 33% as rates climbed.

Bond markets suffer the inverse relationship. When rates rise, existing bond prices fall. If you bought a 10-year Treasury at 2% and rates jump to 5%, your bond is suddenly worthless. Who wants 2% when they can get 5% risk-free? Bond holders lost trillions in 2022. [The bond market collapse was silent but devastating.](Bond Market: The Silent Collapse)

Currency markets explode with volatility. Higher US rates make the dollar a magnet. International investors dump their currencies to buy dollars and capture higher yields. The dollar index surged 20% in 2022, crushing emerging markets. Countries with dollar-denominated debt faced catastrophe.

Real estate follows mortgage rates. When the Fed raised rates from 3% to 7%, home sales collapsed 40%. Prices stopped climbing. The housing boom ended overnight.

This isn’t gradual adjustment. This is financial warfare.

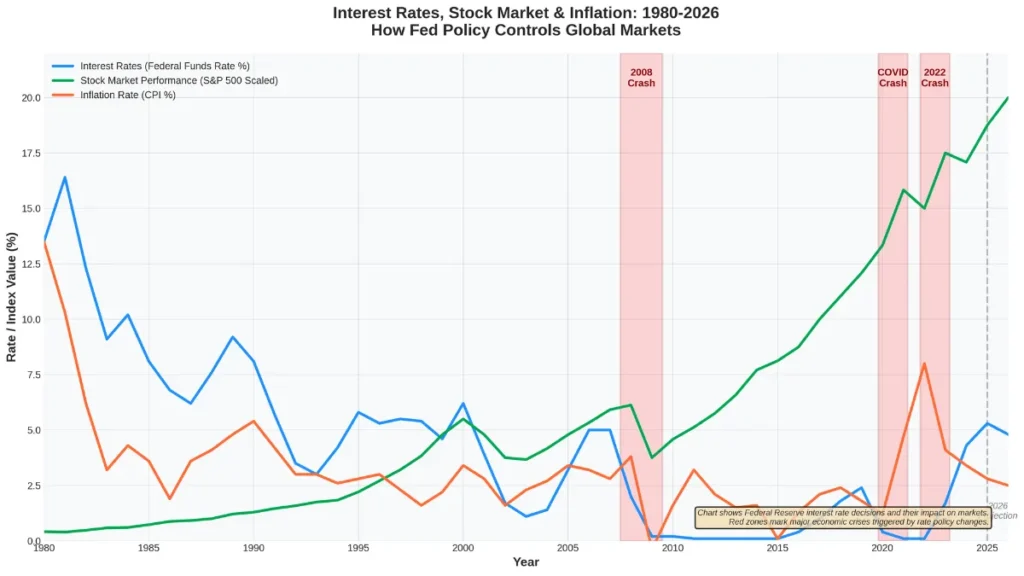

The Timeline of Destruction: When Rates Changed Everything

| Period | Rate Action | Market Impact | Global Result |

|---|---|---|---|

| 1980-1982 | Volcker raises to 20% | Recession, unemployment hits 10% | Inflation crushed, dollar surges |

| 2000-2003 | Dot-com crash cuts to 1% | Tech bubble bursts, housing boom begins | Seeds of 2008 crisis planted |

| 2008-2015 | Emergency cut to 0.25% | Longest bull market in history | Wealth inequality explodes |

| 2020 | COVID cut to 0% | Stocks recover in 6 months | Everything bubble inflates |

| 2022-2023 | Fastest hike to 5.5% in 40 years | $12 trillion erased, crypto crashes | Global recession fears |

| 2024-2025 | Gradual cuts begin | Selective recovery, volatility remains | Markets wait for next move |

Look at that table. Every major wealth transfer in the last 45 years traces back to interest rate decisions.

The pattern repeats: Cut rates, inflate assets, create bubble. Raise rates, pop bubble, consolidate wealth. The wealthy buy the crash. The middle class holds the bag.

Global Stock Market Bubble: Deep Analysis of Valuations & Risks

Is the global stock market bubble real? Explore extreme valuations, liquidity risks, interest rates, and warning signs before the next major crash.

Read Full ArticleThe Global Contagion: Why US Rates Control Every Market

The US dollar is the world’s reserve currency. This means how interest rates control global markets extends far beyond American borders.

When the Fed raises rates, it creates a black hole that sucks capital from every corner of the planet. Money flows from emerging markets to US Treasuries. Countries like Turkey, Argentina, and Pakistan watch their currencies collapse. Their central banks must raise rates to compete, crushing their own economies.

This is why emerging market debt crises follow Fed rate hikes like clockwork. Understanding global liquidity flows reveals the true scope of this destruction.

Japan held rates at zero for decades. Europe followed. But when the Fed moves, everyone must respond. The European Central Bank raised rates despite weak growth. The Bank of England did the same. The Fed leads, the world follows.

Currency wars erupt. Countries try to devalue to maintain exports. But fighting the Fed is financial suicide. The dollar always wins.

Stock Market Manipulation: The Fed’s Direct Pipeline

Here’s what they don’t want you to know: The Federal Reserve directly manipulates stock prices through interest rate policy.

Low rates force investors into equities. There’s no alternative. Bonds yield nothing. Savings accounts are a joke. So money floods into stocks, inflating valuations beyond any rational metric. Price-to-earnings ratios that would’ve been laughed at in the 1990s become normal.

The current market shows every sign of a massive bubble, inflated by a decade of artificially low rates.

When rates rise, the opposite happens. The “risk-free” rate becomes attractive again. Why gamble on stocks when Treasuries yield 5%? Capital exits equities. The Fed doesn’t need to crash markets directly—higher rates do it automatically.

This isn’t market economics. This is planned obsolescence for your portfolio.

The 2026 Question: History Repeating or Different This Time?

We’ve seen this movie before. Twice.

1929: Easy credit inflated the Roaring Twenties. When rates rose and credit tightened, the market collapsed 89%.

2008: Ultra-low rates after the dot-com crash created the housing bubble. When rates normalized, the system imploded.

2026: Are we facing the same pattern? The comparison between these crashes reveals disturbing similarities.

Current debt levels dwarf both previous crises. Corporate debt, government debt, consumer debt—all at historic highs. This debt was affordable at 2% rates. At 5%? It’s a time bomb.

The Fed has two choices: Keep rates high and trigger defaults, or cut rates and watch inflation return. There is no painless exit.

Smart money knows this. That’s why volatility remains elevated despite market rebounds. That’s why gold holds near all-time highs. That’s why Bitcoin survived its crash.

The question isn’t if the next crisis comes. The question is when the Fed’s next rate decision triggers it.

What This Means for Your Money

Understanding how interest rates control global markets gives you one advantage: you can see the trap before it springs.

When rates rise:

- Rotate into value stocks and dividend payers

- Consider shorter-duration bonds

- Hold some cash for opportunities

- Avoid high-growth, no-profit companies

- Watch emerging market exposure

When rates fall:

- Growth stocks and tech outperform

- Real estate becomes attractive

- Risk assets rally hard

- Credit spreads tighten

- The bubble inflates again

But here’s the real lesson: The Fed controls the game, not you. Your best move is understanding the rules they’re playing by.

Watch the Federal Open Market Committee (FOMC) meetings. Read the statements. Ignore the financial media’s instant reactions. The Fed telegraphs its moves months in advance if you know what to look for.

The Uncomfortable Truth

How interest rates control global markets isn’t about optimal economic policy. It’s about maintaining a system that benefits those closest to the money printer.

When rates drop, asset owners profit. When rates rise, the same people buy the crash. You’re always on the wrong side unless you understand the mechanism.

The Federal Reserve isn’t evil. But its tools create winners and losers by design. Every rate decision transfers wealth. The only question is whether you’re on the receiving end or the losing end.

This is why studying past crises matters. This is why watching rate decisions matters. This is why understanding the bond market, currency flows, and Fed policy matters.

Because the next rate change is coming. And it will move trillions again.

Final Word

The Federal Reserve’s control over global markets through interest rates is the most powerful economic force on the planet. One percentage point change moves more money than entire countries’ GDP.

You’ve now seen how the weapon works. You’ve seen the historical carnage. You’ve seen why 2026 could rival past disasters.

The question is: What will you do with this knowledge?

The Fed’s next move is already being planned. Position yourself accordingly.

FAQ on Interest Rates Control Global Markets

How do interest rates control global markets?

Interest rates control global markets by affecting borrowing costs, stock valuations, currency strength, and capital flows. When the Fed raises rates, borrowing becomes expensive, stock prices fall, and the dollar strengthens, triggering worldwide market reactions.

Why did markets crash when interest rates rose in 2022?

Markets lost $12 trillion in 2022 because the Fed raised rates from 0% to 5.5% in the fastest hike cycle in 40 years. Higher rates made stocks less valuable, crushed tech companies with debt, and made bonds attractive again.

What happens to stocks when the Fed cuts interest rates?

Stock markets typically rally when rates are cut because borrowing becomes cheaper, companies can invest more, and investors seek higher returns than low-yielding bonds offer. Rate cuts in 2008 and 2020 triggered massive bull markets.

How do US interest rates affect other countries?

US rate hikes strengthen the dollar and pull capital from emerging markets, causing currency crashes and forcing other central banks to raise their rates defensively. This creates global recession risks and debt crises.

Will interest rates cause another market crash in 2026?

High interest rates combined with record debt levels create crash conditions similar to 1929 and 2008. The Fed faces a dilemma: keep rates high and trigger defaults, or cut rates and risk inflation returning.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Interest rate impacts vary based on individual circumstances, market conditions, and countless other factors. Always conduct your own research and consult with qualified financial professionals before making investment decisions. Past performance and historical patterns do not guarantee future results.

🚀 Join MoneyUncut Telegram

Get real-time insights on Global Finance, Stock Market & Economic Trends.

👉 Join NowAbout the Author – Abhishek Chouhan

Abhishek Chouhan is a Global Finance Analyst and Market Researcher with over 15 years of experience studying stock markets, investor behavior, and long-term wealth cycles across the US, Europe, and Asia. He is the founder of MoneyUncut.com, a global financial intelligence platform focused on decoding market psychology, economic trends, and how human behavior shapes financial outcomes.

2 comments

Comments are closed.